How to Calculate Beta of a Portfolio

Add together the amounts invested in each stock to find the total invested. It equals the weighted-average of the beta coefficient of all the individual stocks.

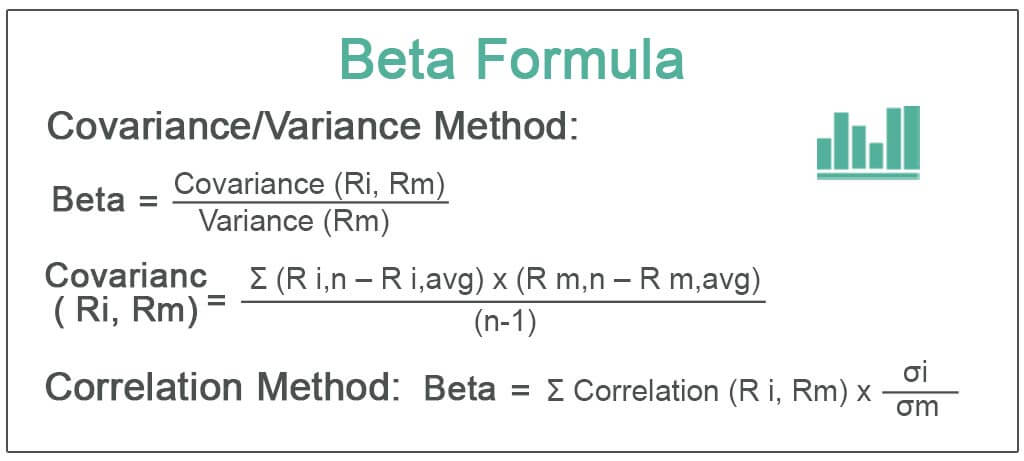

You can calculate Portfolio Beta using this formula.

. This video shows how to calculate the beta of an entire portfolio. Denotes the weight or proportion. In the previous example.

A filing with the Securities and Exchange Commission SEC that must be submitted by a company intending to file a notification of election to be subject to. To calculate the beta of a portfolio you need to first calculate the beta of each stock in the portfolio. As mentioned in the beta calculator the beta of a stock or the beta of a portfolio is a value that measures the extra.

Hi Guys This video will show you an example how to calculate the Beta for a portfolio You own a portfolio that you have invested 2754 in Stock A 1301 i. 5 Accredited Valuation Methods and PDF Report. Then you take the weighted average of betas of all stocks to calculate the beta of the.

No Financial Knowledge Required. Built for Traders by Traders. Ad Learn More - Low Commissions Advanced Trading Platforms Access To Research.

Portfolio beta is a measure of the overall systematic risk of a portfolio of investments. Represents the Beta of the portfolio. Use Excel or spreadsheet software to calculate and recalculate portfolio beta according to market.

We start with a brief beta definition in stock market context. You can determine the beta of your portfolio by multiplying the percentage of the portfolio of each individual stock by the stocks beta and then adding the sum of the stocks. Ad Reliable Valuation -Based on Market Data- to Increase the Success of Your Deal.

We can use the regression model to calculate the portfolio beta and the portfolio alpha. Reflects the Beta of a given stock asset and. We will us the linear regression model to calculate the alpha and the beta.

From novice to expert these are the brokers for you. SEC Form N-6F. The portfolio beta can be computed by taking a weighted-average of the beta for each stoc.

Divide each stock investment by the total invested to find the stocks weight. Makes up 030 of the portfolio and has a beta of 136 then its weighted beta in the portfolio would be 136 x 030 0408. Use spreadsheet software to calculate and update your portfolio beta.

Add up the weighted beta. Our top picks for online brokers. For example if Apple Inc.

Calculate The Beta Of A Portfolio In Excel The Excel Hub Youtube

Beta Formula Top 3 Methods Step By Step Examples To Calculate Beta

Comments

Post a Comment